What You Should Know About Credit Cards for Everyday Use

Related Forms

Schedule B - Personal Property

Schedule C - Property Claimed as Exempt

Schedule D - Creditors Holding Secured Claims

Schedule E - Creditors Holding Unsecured Priority Claims

Schedule F - Creditors Holding Unsecured Nonpriority Claims

Schedule G - Executory Contracts and Unexpired Leases

Schedule I - Current Income of Individual Debtor(s)

Schedule J- Current Expenditures of Individual Debtor(s)

Summary of Schedules (Includes Statistical Summary of Certain Liabilities)

View All

Often, when people consider financial loans, they recognize these loans as home mortgage loans and car loans. In other words, loans are granted by lenders to assist a consumer in making expensive purchases. However, these are not the only times that consumers utilize loans and credit lines.

Statistics indicate that over fourteen million people throughout the world use a consumer credit service to make everyday purchases. The most common type of consumer credit service used regularly is credit cards. Most individuals in the United States have at least one credit card. In many cases, one individual will possess multiple credit cards. This consumer credit service allows individuals to purchase products and pay for these items later.

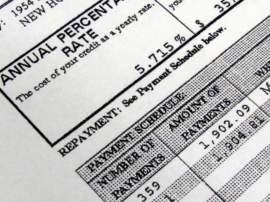

A lender will specify a credit limit, which the debtor may not exceed. Borrowers will be permitted to make purchases using credit cards, granted they regularly pay the minimum monthly payment. Due to the benefits and convenience associated with using credit cards, many individuals have begun using this consumer credit service to pay for everyday purchases.

If an individual is responsible when utilizing

this consumer credit service, credit cards present individuals with a favorable

convenience. While a transaction involving money may take a few minutes to complete,

credit cards finish a purchase with a quick and hassle-free swipe. This

decreases the amount of time that a consumer spends at a cash register.

Another benefit of purchasing everyday items with a credit card is the rewards programs that are offered for loyal borrowers. For example, many credit card companies allow borrowers to accumulate "frequent flier" miles when they spend certain quantities of money using their credit card. Therefore, a consumer may receive a free airplane flight as the result of making purchases that he/she would have made using money anyway. The rewards programs attached to credit card purchases vary based on the credit card company from which an individual is borrowing.

The majority of credit

cards are accepted at most locations for many different goods and

services. An individual may purchase groceries, movie tickets, and books using

a credit card. It is very rare for a consumer to walk into a store that does

not accept credit cards. Some locations, such as restaurants, may specify a

minimum fee for the use of a credit card. However, other businesses may allow

an individual to utilize a credit card to make a purchase as small as $1. Many

people even use credit cards to buy their morning coffee.

In short, credit cards have become an integral

part of the economy and of everyday life. As long as an individual is

responsible with his/her credit line, he/she may utilize a credit card to make a

variety of everyday purchases. If a consumer is able to do this, he/she will

establish an excellent credit history and will be deemed to be creditworthy by

all potential lenders. Consumers are often warned against using credit

cards in everyday transactions, though, as failure to responsibly handle a

line of credit may result in unmanageable debt and financial trouble.

NEXT: 4 Kinds of National Global Influences on Debt