Facts to Know Before Obtaining a Savings Account Loan

Related Forms

Schedule B - Personal Property

Schedule C - Property Claimed as Exempt

Schedule D - Creditors Holding Secured Claims

Schedule E - Creditors Holding Unsecured Priority Claims

Schedule F - Creditors Holding Unsecured Nonpriority Claims

Schedule G - Executory Contracts and Unexpired Leases

Schedule I - Current Income of Individual Debtor(s)

Schedule J- Current Expenditures of Individual Debtor(s)

Summary of Schedules (Includes Statistical Summary of Certain Liabilities)

View AllYoung adults just becoming acquainted with managing their own financial affairs may only see a bank as a place to store their money and take it out as needed. Those more familiar with how these financial institutions operate, though, understand that banks may be so much more. For one, the type of account for which a party signs up may be highly specific to their purpose. There are important distinctions to be made, for example, between checking accounts and money market deposit accounts.

On top of this, banks may serve an equally important service as a lender. Certainly, banks have the means and reputation to issue loans to average people. The question of eligibility, of course, lies with the loan applicant. If personal credit is to have a bearing on opening a savings account, it will likely affect an applicant's ability to secure a loan. Nonetheless, after credit is established and maintained with said savings account, this may be used as a gateway to an extension of credit via a savings account loan.

Some notes on savings account loans and how they may be obtained:

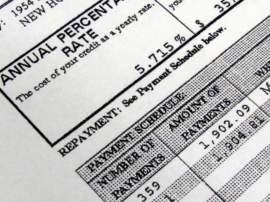

To understand how to get a savings account loan, it would be helpful to know what one is. Savings account loans, known in some circles as passbook loans, are secured loans. A savings account loan is a high-interest, low-risk arrangement between borrower and lender.

For the debtor, the interest charged on savings account loans is higher than with other loans and for those of debtors with higher credit ratings. As is consistent with other methods of credit repair, these rates are the literal price that must be paid for the good that may be earned towards one's credit.

For the bank, what makes them receptive toward issuing someone a savings account loan is the low risk involved. If debtors default on their savings account loans, their accounts serve as the collateral and their contents may be reclaimed accordingly.

In obtaining a savings account loan, the process is as simple as filling out an application, but it should be noted that there are requirements and stipulations attached to securing this type of credit. Firstly, banks do not let debtors borrow against the entirety of their savings accounts, but rather about 80 to 90 percent of them.

They will also have bank-specific minimum deposits for taking out these loans. In addition, the issuer of a savings account loan will usually specify a minimum payment per month and the length of the loan repayment period required.

NEXT: Australia