All You Need To Know About Credit Loan Refinancing

When an individual has incurred more debt than he/she can handle and is experiencing difficulties paying his/her loans, one option the debtor may consider is credit refinancing. Many borrowers that experience financial trouble, in fact, take steps towards loan refinancing. This maneuver is intended to provide a debtor with realistic options for repayment.

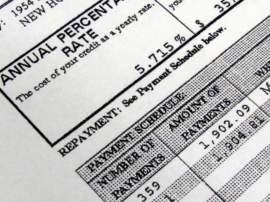

When an individual initiates credit refinancing, he/she applies for another loan to cover the value of an initial loan. The newly-acquired loan amount will be paid to the original lender and the borrower will then be required to repay the new creditor as opposed to the initial creditor. A debtor may also secure a large loan to cover the cost of numerous smaller loans. In instances such as this, credit refinancing does not necessarily require an individual to change lenders. Loan refinancing often offers debtors a more suitable alternative to bankruptcy.

There are numerous reasons that an individual may

engage in loan refinancing. In many instances, the terms and conditions of a

new loan may be preferable to those of an existing loan. Loan refinancing may

allow an individual to obtain a loan with a lower interest rate.

Replacing an existing loan with a low-interest loan may help a debtor save a

great deal of money. Also, credit refinancing may allow an individual to

achieve lower monthly payments on a loan. This may be very beneficial for an

individual that is subsisting on a low income and experiencing difficulties

addressing his/her monthly debts. A smaller monthly obligation may help to

ensure that a debtor does not fall behind on his/her payments.

Another

scenario in which an individual may seek credit refinancing is when he/she

chooses to consolidate his/her debts. It is common for consumers to run up many

different debts, including car loans, credit card debts, and school loans.

Plus, borrowers will pay interest on each of these debts. By consolidating

these loans through loan refinancing, a borrower may save a noticeable amount

of money.

The most common type of credit refinancing is home

mortgage refinancing. A home mortgage loan is a sizable financial obligation,

which may leave homeowners with more debt than they can handle. Refinancing a

home mortgage loan may result in smaller monthly payments, allowing a debtor to

avoid foreclosure.

However, loan refinancing can be applied to different types of debts. If a debtor is contemplating credit refinancing, it is advisable that he/she explore numerous different creditors and weigh his/her choices. Every lender offers loans with different terms and agreements. A debtor should also carefully analyze his/her financial situation in order to ensure that refinancing is sensible for his/her circumstances in the first place.